The Main Principles Of Mileagewise - Reconstructing Mileage Logs

Table of ContentsMileagewise - Reconstructing Mileage Logs Things To Know Before You BuyThe 25-Second Trick For Mileagewise - Reconstructing Mileage LogsTop Guidelines Of Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedThe Single Strategy To Use For Mileagewise - Reconstructing Mileage LogsOur Mileagewise - Reconstructing Mileage Logs StatementsWhat Does Mileagewise - Reconstructing Mileage Logs Do?

Timeero's Quickest Distance feature recommends the shortest driving course to your workers' destination. This attribute enhances productivity and contributes to set you back financial savings, making it an important asset for companies with a mobile workforce.Such a technique to reporting and compliance simplifies the frequently complex job of managing gas mileage expenses. There are several advantages associated with utilizing Timeero to keep track of mileage.

Get This Report about Mileagewise - Reconstructing Mileage Logs

With these tools in use, there will certainly be no under-the-radar detours to raise your repayment costs. Timestamps can be located on each gas mileage access, increasing reliability. These additional verification actions will certainly maintain the internal revenue service from having a reason to object your mileage documents. With precise gas mileage monitoring innovation, your staff members don't need to make harsh gas mileage estimates or perhaps bother with gas mileage expense tracking.

If a worker drove 20,000 miles and 10,000 miles are business-related, you can compose off 50% of all vehicle costs (mileage tracker app). You will certainly require to proceed tracking mileage for work also if you're utilizing the real expense method. Keeping mileage documents is the only method to different service and personal miles and offer the proof to the internal revenue service

A lot of gas mileage trackers let you log your journeys manually while computing the distance and repayment quantities for you. Several additionally featured real-time journey tracking - you require to begin the app at the beginning of your trip and quit it when you reach your last destination. These apps log your begin and end addresses, and time stamps, along with the complete distance and reimbursement amount.

The 5-Second Trick For Mileagewise - Reconstructing Mileage Logs

This consists of costs such as fuel, maintenance, insurance policy, and the lorry's depreciation. For these expenses to be thought about deductible, the automobile ought to be made use of for company functions.

Some Of Mileagewise - Reconstructing Mileage Logs

Start by videotaping your car's odometer analysis on January 1st and after that again at the end of the year. In in between, vigilantly track all your organization journeys writing the beginning and finishing readings. For every trip, record the location and service purpose. This can be streamlined by keeping a driving visit your automobile.

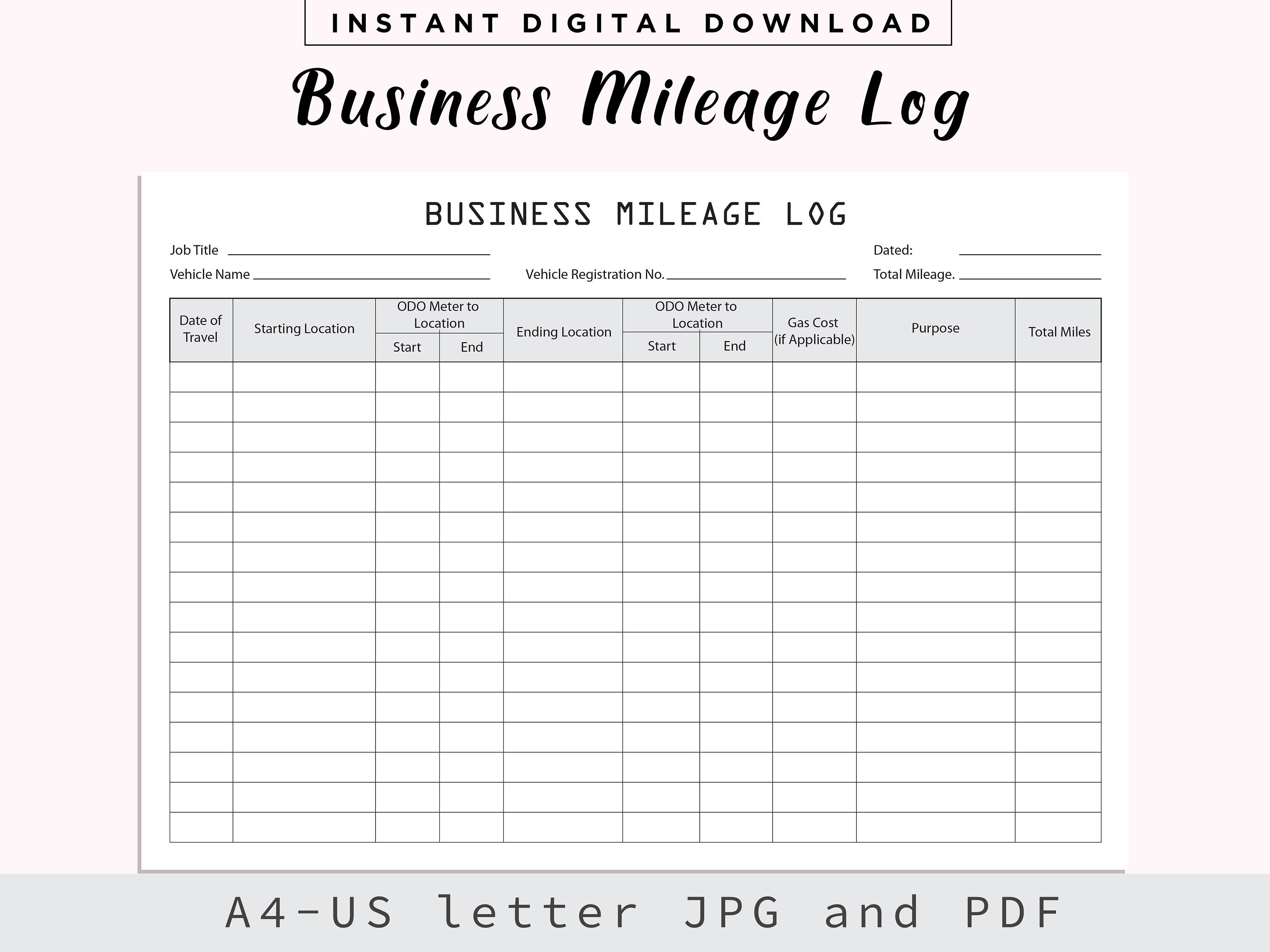

This consists of the overall organization mileage and complete gas mileage accumulation for the year (organization + personal), journey's day, destination, and objective. It's important to tape activities without delay and maintain a synchronous driving log describing date, miles driven, and organization objective. Right here's exactly how you can boost record-keeping for audit purposes: Start with making certain a careful gas mileage log for all business-related travel.

Get This Report about Mileagewise - Reconstructing Mileage Logs

The actual expenses method is an alternative to the try here standard mileage rate technique. Rather than calculating your reduction based upon a fixed rate per mile, the actual expenses method allows you to subtract the actual expenses connected with utilizing your lorry for business purposes - best mileage tracker app. These expenses include fuel, maintenance, repairs, insurance, depreciation, and various other relevant costs

Nevertheless, those with significant vehicle-related expenses or distinct problems may gain from the real expenditures technique. Please note choosing S-corp standing can change this computation. Ultimately, your selected method should straighten with your specific monetary goals and tax obligation circumstance. The Requirement Gas Mileage Rate is an action provided yearly by the IRS to determine the deductible costs of running a vehicle for organization.

Get This Report on Mileagewise - Reconstructing Mileage Logs

Keeping an eye on your mileage by hand can call for persistance, but bear in mind, it can save you money on your tax obligations. Adhere to these steps: List the day of each drive. Videotape the total mileage driven. Take into consideration noting your odometer analyses prior to and after each journey. Jot down the beginning and ending points for your journey.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone

In the 1980s, the airline sector ended up being the very first industrial users of general practitioner. By the 2000s, the delivery industry had adopted general practitioners to track bundles. And now virtually every person utilizes GPS to navigate. That suggests almost every person can be tracked as they go regarding their company. And there's snag.

Comments on “Not known Details About Mileagewise - Reconstructing Mileage Logs”